Seth Grahame-Smith has had enough of this one-way relationship:

She has no idea.

She has no idea how many times I defended her. How many right-leaning friends and relatives I battled with. How many times I played down her shady business deals and penchant for scandals — whether it was Whitewater, Travelgate, Vince Foster, Cattle Futures, Web Hubbell, or Norman Hsu. She has no idea how frequently I dismissed her husband’s serial adultery as an unfortunate trait of an otherwise brilliant man. For sixteen years, I was a proud soldier in the legion of “Clinton apologists” — who believed that peace and prosperity were more important than regrettable personality traits.

And then she ran for president.

Read the rest of this cautionary tale of lust, passion and betrayal.

Proud soldier in legion. Bill had a lot of those. Bill’s foot soldiers, legion, Florida. They made sure you did everything right or they pained you or a stroke or heart attack or something. Luciferian legion of lawyer Bill’s chosen suers. The vote is life or death, so most of us went along with the 70s and decided that if you don’t vote, dems and Bill’s legion of luciferian painers won’t kill ya. Those 70s guys lived a long time, just quit voting.

I’ll take your word for it, KU.

Terrorists just attacked my body, heart. We call those luciferian bio terrorists in Florida and just sell luciferians when it happens with the water or whatever. Hey, maybe it’s the express lane for the vote!!!

Are those anything like Rastafarians?

I ALMOST feel sorry for the Dems in a way. I mean, really, many of them sold themselves out defending these fucks for years… ditching any sense of self-esteem they might have had in the process. The guy was scum and they knew it. His wife was pathetic… and they knew that too. But it was the height of changiness and the height of PC relativism… and most of the defenders were young[er] and without very well-formed life-philosophies themselves. Of course they’re disillusioned. It’s called coming of age. “An old man who is a liberal has no brain.” Now the next thing they’ll regret is that when they supported higher taxes for the “rich” (those making more than a whopping 90k), they really had no idea they might one day earn so much and still be living check to check. Better late than never, I guess. But they kind of owe the rest of us who knew better and would not make excuses an apology.

How’s it going, Enoch?

decent. and you?

Scraping by. Busy week ahead. Mairead’s enjoying talking to Dilly over IM.

You’ll have to write me about what you’re up to with Jim.

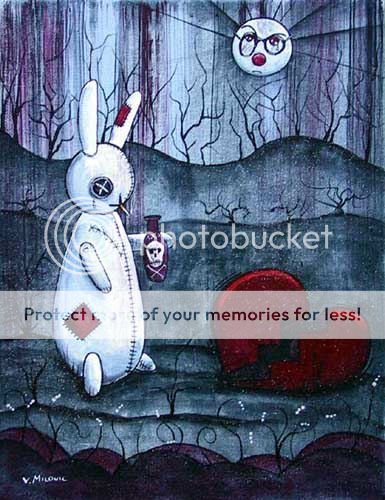

Dan, very strange and appropriate art work. Thanks for linking me an interesting article. Unless Obama pulls off a miracle or McCain loses his temper big time I see President McCain inheriting Bush’s mess. Good luck , USA.

E, couldn’t understand why it took ’til age 15 to figure out that the moon doesn’t make it’s own light….still believe in Santa Claus? You better read Ben Stein for a reality check. And read this guy Henry C.K. Liu for an economic measure of something besides Who Wants to be a Millionaire. Besides the more you earn over 90k the more your taxes go down as no more payroll taxes after that..until hopefully an increase is made there to rectify that imbalance.

Well, that’s me all over, Dave: strange and appropriate.

Yes, Dan. I enjoyed the thread about relative left and right Catholic bashing and the Texan debacle. Very enlightening. Lutheran activities in the Nazi movement rectified my own beliefs about Catholics being too responsible for a lot going on then. At worst, the Church was a unholy bystander in those dark times, me thinks.

Enoch, didn’t mean to sound too mean spirited. Just my nature. But I read part of your blog but didn’t have time to register to log in. Off to work I go.

Very strange that Ben Stein and I think alike.

Indeed it is, Dave, particularly when the actual problem is spending, not revenues. That neither party seems willing to do anything about it doesn’t change that fact.

That was a very disturbing article, Dan. Some people just get WAY too much into their politics.

Methinks it’s mostly those who need something with which to replace religion.

Yes, let’s tax ourselves into prosperity. Raise the top marginal rate to 100% and we’ll all be rich!

But thanks for the info, dave. Now we all know you make less than $90k/yr. Loser.

Dave, you seriously need to understand what payroll taxes are. The whole thing, I mean. Hint: “Social Security” is not interchangeable with “payroll taxes”.

Indeed, Slarti…Medicare is like the Energizer bunny: it keeps going and going…

Dave, in case you’re still around, there is no decline in payroll tax, or even payroll tax rate, anywhere. There are places where the tax rate fails to increase, though: specifically, two. First, there’s the bottom-bracket, because there’s no rate blending going on to the bracket below that one; there isn’t one. From $0 to $7825, you pay flat 10% Federal, plus the other payroll taxes for a flat total of 17.65% across the range. Them above the social security cap, there’s a flattish space from the cap up to the bottom end of the next bracket (slope is actually a small positive number) at $160k, and then it goes up from there. Tax rate at the flat spot is about 29%.

That’s for single-taxpayers. I’d have to redo it for married, etc, and I’d have to redo a more involved spreadsheet, with a number of investment and homeowning options, to factor in all the stuff simplistic analysis can’t. But dave’s basic point is incorrect: there are no income levels that see payroll taxes decrease, in total or percentage, below that of lower incomes.

Weird. Well, I posted something to the effect that there was NO income range for which the slope of payroll tax rate was negative. But the cat ate it.

Ah, there it is.

I love the infighting. I also love the way the Clintonistas are only NOW realizing what slime the couple were/are.

It’s time for a self-righteous “I told ya so!” on the part of ALL of us who knew the deal from the start.

I read one comment to the effect that Clinton “saved us” from 30 years of Republicans in the Presidency. How convenient that they forget that they really had Perot to thank for Clinton in the first place. If he hadn’t run, Bush I would have won in a landslide….

Good luck with that. You can’t shame the shameless.

Okay, I meant Fica taxes….(2008) which are capped at $102,000 employee’s portion is 6.2% paying no more than $6,324.00 per year. I’ve heard discussions that only considered payroll taxes as social security and medicare taxes. As a former small employer I considered the whole costs of employment.. the full approx. 15 percent for social security and medicare plus about 7 percent for unemployment then insurance and it adds up much more than the stated wage rate. Now being ‘self employed’ my Fica tax is huge. I heard that 80 percent of Americans paying taxes pay more Fica than income tax.

Sorry I wasn’t more clear. http://en.wikipedia.org/wiki/Payroll_taxes

Jeesh, Spitzer really boobooed.

glad you’re doing so well, Kelly.

Uh, dave? FICA is SS and Medicare taxes. Wiki.

Another ? are Medicare taxes capped or not?

“2. Medicare Tax: As of 2007, the employer must withhold 1.45% of an employee’s wages and pay a matching amount for Medicare tax. The total is 2.9% for the employee and the employer. Unlike the Social security tax, there is no maximum wage base for the Medicare portion of the FICA tax. Both the employer and the employee continue to incur and pay Medicare tax on each additional amount of gross compensation, with no limit on the amount of gross compensation on which the tax is imposed.”

okay…

so it doesn’t seem much…but due to not having a cap much more money is avail. to medicare than it’s small percentage. Another reason to remove the cap for social security and lower the rate

The problem with that, dave, is that SS payments out, on retirement, are scaled to payments in, pre-retirement. If you collect more from higher incomes, you’ve got to pay more out. No net savings, in other words.

Now, if you cap the payout, or make it needs-based, I’m ok with that. But a whole lot of Democrats would (and have done so, in recent memory) rise up in fury to oppose such a suggestion, unless it came from their side of the aisle.

I am sorry, Slark, that I didn’t back to you on this. Been working. But I think you are correct: cap the S.S. payout at a certain level but not cap the income to be taxed. Then it’d be a truly ‘flat tax’ which conservatives have wanted for a long time…but currently it is a regressive tax as the real high income’ers pay less in percentage in income as their incomes get higher and higher. Make it need’s based but within reason (so to not alienate the higher incomed people who should get something even if not needed but not so much to just waste it… so as to not alienate hardworking successful people which is what I think was FDR’s reasoning?) ..and lower payout rates (if someone already has adequate income).

Nearly 14 percent per worker’s actual pay is way too much. Social Security is the Piggy Bank that the Fed’s use to fund the heavy deficits in the other columns.

I know many conservatives have called it a regressive tax as I said. Sorry about confusing it with general “payroll taxes” although for most people social security is the biggest part of it…in the average range of income which seems to be lower than most PW’ers here…but I am right smack in the middle at a measly 40+K a year.–My fault for picking trades work (which is sort of my self occupational therapy) rather than being driven money hounding…imagine me being a health care insurance salesman! Just a laugh.

“Then it’d be a truly ‘flat tax’ which conservatives have wanted for a long time”

Except it’s not a tax, at that point; it’s some in-between state ‘twixt tax and entitlement. Again, this is something that seems to get the left-hand side of the aisle more riled up than the right-hand side, for reasons that escape me. It’s almost as if, on this one issue, there’s been a swap of principles: much of the Right wouldn’t mind seeing it phased into more of an entitlement, while most of the Left seem to think that’s a bad thing.