Aside from common sense reasons, like, eg., money will move offshore and leave the country entirely.

The top marginal tax rate was 91% during the 1950s. Here’s why we can’t go back:

1. The 1950s was no Golden Age. The U.S. economy grew by an average of 3.4% a year between 1948 and 2007. How did the 1950s do in comparison? If you measure the 1950s from 1950 to 1959, it did a bit better than average, growing at an annual rate of 3.6%. If you measure the decade from 1951 to 1960, it grew at a below average 3.0% rate. The period also saw three recessions, July 1953-May 1954, August 1957-April 1958, and April 1960-February 1961. Now, overall, it was a strong period for the economy, especially for folks with still-fresh memories of the Great Depression. But recall that John F. Kennedy’s 1960 presidential campaign said he would “get this country moving again.” That’s a slogan a politician uses after a decade of stagnation, not hypergrowth. (Of course, JFK sharply cut taxes and the economy boomed.)

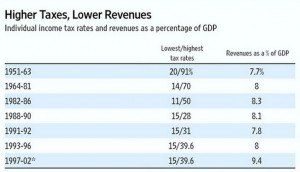

2. Real tax rates were a lot lower. Even Levine concedes that “not many people paid that much. Only three baseball players — Ted Williams, Joe DiMaggio and Willie Mays — got there.” Indeed, the top effective tax rate was probably somewhere between 50-60% because of a tax code full of loopholes. Now that’s still higher than today’s top effective tax rate of around 30%. But those 1950s tax rates actually generated less tax revenue than subsequent periods of lower rates. From 1950 to 1963, income tax revenue averaged 7.5 percent of GDP, that’s less than in the Reagan years when rates were being slashed. This could suggest rates are right around the Laffer Curve equilibrium point in the current economy. Indeed, the following chart from the WSJ makes this calculation over a variety of time periods:

3. The post-war U.S. economy was in an incredibly strong international position. Did the the “91% or Bust” crowd forget about World War Two? A National Bureau of Economic Research study described the situation this way: “At the end of World War II, the United States was the dominant industrial producer in the world. With industrial capacity destroyed in Europe—except for Scandinavia—and in Japan and crippled in the United Kingdom, the United States produced approximately 60 percent of the world output of manufactures in 1950, and its GNP was 61 percent of the total of the present (1979) OECD countries. This was obviously a transitory situation.”

When you’re as dominant as the U.S. was, it papers over a lot of bad economic policy coming from Washington. Today, of course American competes with a slew of strong, technologically advanced economies including the EU, China and Japan.

4. Even economists who argue for higher tax rates don’t want to go back to the 1950s. The New York Times just ran of profile of economists Thomas Piketty and Emmanuel Saez, who are very influential on the left and with the Obama White House. The piece summed up their views: “As much as Mr. Piketty’s and Mr. Saez’s work has informed the national debate over earnings and fairness, their proposed corrective remains far outside the bounds of polite political conversation: much, much higher top marginal tax rates on the rich, up to 50 percent, or 70 percent or even 90 percent, from the current top rate of 35 percent.”

So 91% or bust? Not so fast. Here is Piketty in another interview:

Does the fact that the United States did it in the past necessarily imply that we should immediately return to 80-90 percent top marginal rates? Of course not. … It could be that the right level is 70 or 60 percent. … Most importantly, I said very explicitly that I was talking about very, very high incomes, and that at least 99.5 percent of the population would be unaffected by this new top rate. … I firmly believe that imposing a 70 or 80 percent marginal rate on large segments of the population (say, 25 percent of the population, or even 10 percent, or even a few percentage points) would lead to an economic disaster. And I made very clear that the reason I propose to focus on the very top end because this is where the labour market and the pay determination process are not working properly—or, more accurately, have completely gotten out of hand.

And, of course, an ultrahigh tax rate on an initially small slice of the population, like Obama’s Buffett rule imposes, would neither raise very much revenue not do anything to create jobs. And look at what just happened in Great Britain. Their Independent Fiscal Oversight Commission — which reviews all of the budgetary assumptions — just ruled that cutting the top rate of tax from 50 to 45 was revenue neutral, implying the revenue maximizing rate is in that range. The Brits don’t have state income taxes which implies by extension that our revenue maximizing federal rate is lower than theirs — a whole lot lower than 70,80 or 90%.

Gimmicks like the Buffett rule are not meant to be serious policy positions. They are instead cynical (and obvious) political ploys in the service of a greater narrative, namely, the Marxist socialist narrative favored by the left, which relies on scapegoats and “speculators” and identity politics warfare to keep us distracted while the governing class colludes with big business to form a liberal fascist state — which I’ve long argued is the preferred resting place of Marxist Utopians: the ruling class and big corporations join forces in a way that is mutually beneficial, with the partnership serving at once to drive competition from the marketplace while simultaneously entrenching a centralized command-and-control economy through bureaucracies, taxes, and the regulatory apparatus of the State.

In Edward Bellamy’s socialist Utopia, Looking Backward, the final stage, following from liberal fascism, was for the government to then take over those big corporations through nationalization, thus “evolving” us from a capitalist free market society into a society fully run by a ruling bureaucracy — benevolent, of course, with the masses perfectly content in the end with their new secure positions.

But that last step, the ruling class correctly surmised, is unnecessary and in fact, counterproductive: there are certain perks that come with being the decider that disappear once everything is decided. And besides, a society in the liberal fascist state can keep up the trappings of representative government — even though so much of what government does is beyond the reach of the voters or even a given political party.

So. May as well keep up the perception of liberty if it don’t cost you anything to do so, right? I mean, what good is it to be a rank cynic if you can’t take advantage of that missing moral compass…?

God only knows what those crazy Americans will do when they get their hands on themselves once again.

You’re summation, as always, is dead on Jeff. Your first paragraph pretty much took care of my comments. Which leaves me with a question.

Why is it that when I want some to the point, keen analysis of some event of the day, I can always find it here, but never with the people- hello elected reps and GOP- who are supposed to be bringing up these points and hammering away at them.

I have an idea to throw the entire system into an apoplectic fit by writing in Jeff for POTUS, and his merry band of commenters as his cabinet.

That oughta hold ’em.

“. . . his merry band of commenters as his cabinet . . . ”

Dibs on the liquor cabinet!

I predict the first scandal of Jeff’s administration will involve sdferr.

Well, as long as they bring back the room and board deduction for my slaves, I’m OK with the economics of the past.

Yea yea yea … but it will be MORE FAIR.

Dog-gone-it, I didn’t eat the family pet, I just need a drink.

Heh

sdferr, today’s Treacher & Iowahawk Twitter feeds.

Enjoy.

I’m surprised nobody has come up with a wagyu dog joke yet.

Heard a good one on the radio. “I suppose this explains what happened to the Blue Dogs.”

Or puppy chow.

Maybe he can borrow Professor Reynolds’ puppy blender.

Release the hounds!

OT:

Dick Clark has passed away.

Pass the Balto.

That’s sad, bh. He’s kind of an institution.

But I can’t say I’ll miss him on New Year’s Eve. He’d begun to bring me down.

Dick Clark is gone? Now there’s a guy I thought really was going to live forever.

Him and Jack LaLanne.

Will there be a Secretary of Gadgets office? If so, can I apply?

I believe Chicago Jesus has a patent on gadgetry and all things gadgets ; but I’m sure Jeff could throw in an EO to smooth it over.

Apologies to any Mexicans who might have actually seen the image of Jesus in a tortilla or whatever, but…are you fucking serious.

Worst. Cult Ever.

Oooh! Since we’re making up Liquor Cabinet posts, a guy with the name Johnnie Walker has to be in it. Can I be Secretary of Blowing Shit Up?

On topic, I notice Zachriel has not taken to commenting on tax rates in this post…

I guess I wasn’t the only one then. It was disconcerting for me because for the previous twenty years the Dick Clark joke was that he never aged.

Him and Jack LaLanne.

I bought Lalanne’s Juicer.

Figured if I mix my booze with whatever comes out the end of the Juicer, I’m good ’til I’m like 85-86.

Worst. Cult Ever.

Yea, and this cult isn’t going to have the happy ending that the Heaven’s Gate one did.

I mean, aren’t they soaring around the galaxy on Haley-Bopp ?

I was a member of the original Liquor Cabinet,

http://archives.nodepression.com/1996/11/jack-logan-liquor-cabinet-mood-elevator/

(quit before this record) so count me in.

For those of you in the SE, Jack has formed a new band, the Coventry Climax, of which I am a member and we will be playing gigs at the end of March at Hendershot’s in Athens, and opening for Jay Gonzalez of the Drive By Truckers at the 40 Watt the beginning of June. Should be fun.

B Moe, what do you play? In addition to my multitude of other sins, I play bass in an old man rock band. We do the Suburban Basement Tour, never having graduated to Garage Band status.

Guitar. Played bass in the early Liquor Cabinet because nobody else could, but I mainly play guitar.

I can’t help but think I’d be best suited to be on the Secret Service detail that watches over the armadillo.

Even better if the Secret Service is reorganized into GSA.

I’m surprised nobody has come up with a wagyu dog joke yet.

It was one of the first last night on #ObamaDogRecipies.

Prolly swallowed in the feed by now.

I can’t help but think I’d be best suited to be on the Secret Service detail that watches over the armadillo.

I’ll be in charge of the chickens. Michelle has soured me on the idea of being a fitness czar.

Does the White House have a bartender? I’m not qualified but I do pour friendly.

Can I be ambassador to Iraq?

Swen, you know the definition of a really good friend? A buddy who goes into town, gets two BJs, comes back and gives you one.

Badabing.

gads, the 1950s as the Golden Age of taxes?

Forget Mad Men for a minute and understand that people got along on a lot less salary and prices were low because there just wasn’t a lot of stuff to buy that one could afford.

My parents’ first house bought in 1954, GI bill, 1200 sq ft basic home $14,000. My mom was a SAHM, they had one car and she dreamed they would be living easy if my dad could net $100/week. One party line phone, radio for the first few years plus paperback books were entertainment. (I barely remember our first tv about 1957 which was 2nd hand from my uncle).

If someone lived like we did in 1950 they’d be classed as ‘working poor’ or low-income. But we were middle-class my dad with a white collar job.

Darleen, almost exact same recollection as you. And I never felt poor. Hell, life was good. I never felt poor until I started paying a lot in taxes.

My parents’ first mortgage payment (ca., 1958 or so) was $65/month. My cell phone bill is higher than that. Hell, I pay more than that PER DAY for preschool for 2 girls. The ’50s were ok, but I wouldn’t want to go back to that.

I hate the time machine… but I can’t resist reading the comments. To the post; there is only one thing certain in life… death and taxes, not necessarily in that order thought certainly not precluding it. There is no perfect tax.